Payback Period: Formula and Calculation Examples

The metric is used to evaluate the feasibility and profitability of a given project. Are you looking to calculate the payback period for an investment project using Microsoft Excel? The payback period is an essential financial metric that indicates the time required for an investment to recoup its initial cost. It is a crucial measure for businesses to determine the profitability and risk of a potential investment.

Payback Period vs. Discounted Payback Period

Solar payback periods can vary widely, and also depend on how you pay for the system in the first place. A “solar payback period” is a fancy way of talking about how long it takes for the money you spent to be outweighed by the money you’re saving (or earning) on your electricity bill. Depreciation is a non-cash expense and therefore has been ignored while calculating the payback period of the project. The situation gets a bit more complicated if you’d like to consider the time value of money formula (see time value of money calculator). After all, your $100,000 will not be worth the same after ten years; in fact, it will be worth a lot less.

How to Change Chart Type in Excel

As the equation above shows, the payback period calculation is a simple one. It does not account for the time value of money, the effects of inflation, or the complexity of investments that may have unequal cash flow over time. Most capital budgeting formulas, such as net present value (NPV), internal rate of return (IRR), and discounted cash flow, consider the TVM. So if you pay an investor tomorrow, it must include an opportunity cost.

NPV Formula: How to Calculate Net Present Value

The discounted payback period is the number of years it takes to pay back the initial investment after discounting cash flows. In Excel, create a cell for the discounted rate and columns for the year, cash flows, the present value of the cash flows, and the cumulative cash flow balance. Input the known values (year, cash flows, and discount rate) in their respective cells. Use Excel’s present value formula to calculate the present value of cash flows. For instance, a $2,000 investment at the start of the first year that returns $1,500 after the first year and $500 at the end of the second year has a two-year payback period.

- Or maybe there’s something else going on at the plant that prevents it from functioning properly.

- One of the most important concepts every corporate financial analyst must learn is how to value different investments or operational projects to determine the most profitable project or investment to undertake.

- Are you looking to calculate the payback period for an investment project using Microsoft Excel?

- Since the second option has a shorter payback period, this may be a better choice for the company.

- Understanding the way that companies calculate their payback period is also helpful to determine their financial viability and whether it makes sense for you to invest in them as part of your portfolio.

Cost of electricity and rate of increase

The payback period is the amount of time for a project to break even in cash collections using nominal dollars. It’s important to consider other financial metrics in conjunction with payback period to get a clear picture of an investment’s profitability and risk. Any particular project or investment can have a short or long payback period. How investors understand that period will depend on their time horizon.

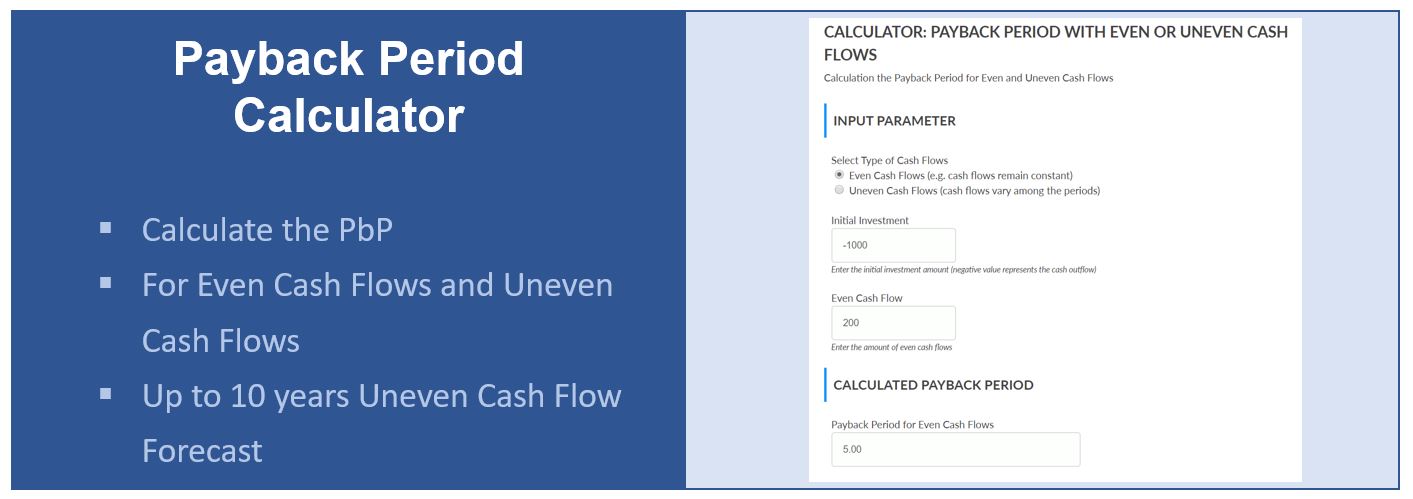

Under payback method, an investment project is accepted or rejected on the basis of payback period. Payback period means the period of time that a project requires to recover the money invested in it. The above equation only works when the expected annual cash flow from the investment is the same from year to year. If the company expects an “uneven cash flow”, then that has to be taken into account. At that point, each year will need to be considered separately and then added up. Cash flow is the inflow and outflow of cash or cash-equivalents of a project, an individual, an organization, or other entities.

This works well if cash flows are predictable or expected to be consistent over time, but otherwise this method may not be very accurate. Take an example where payback period formula a project requires an initial investment of $150,000. In its first three years, the project is expected to return net cash of $10,000, $25,000, and $50,000.

The payback period is the time it will take for a business to recoup an investment. Management will need to know how long it will take to get their money back from the cash flow generated by that asset. The payback period can apply to personal investments such as solar panels or property maintenance, or investments in equipment or other assets that a company might consider acquiring. Often an investment that requires a large amount of capital upfront generates steady or increasing returns over time, although there is also some risk that the returns won’t turn out as hoped or predicted. The payback period is calculated by dividing the initial capital outlay of an investment by the annual cash flow.