Real Estate Tax vs Property Tax: Key Differences

General property taxes are the financial backbone of local government. These recurring charges, typically billed annually or semi-annually, fund the services that make communities function. Bookkeeping for Chiropractors Yes, landlords pay real estate taxes on rental properties just like homeowners. These costs can sometimes be factored into rental pricing to offset annual expenses. You can estimate property taxes by checking local tax assessor websites or using online property listings.

- Comparable sales, or comps, are a strong starting point for an appeal but not the entire solution.

- The map below shows the geographic variation of average annual real estate taxes (RETs) paid.

- They’re a significant ongoing cost that directly affects whether you can afford your mortgage payment each month.

- Bookmark our page to learn about upcoming property tax changes and current property tax rates in your state, county, and city.

- Barns, large workshops, investment properties – all of those properties are included.

Factors Affecting Tax Rates

Moreover, tax planning and compliance have a direct impact on personal finances, influencing savings, investments, and financial decisions. LMB Mortgage Services, Inc., (dba Quicken Loans), is not acting as a lender or broker. The information provided by you to Quicken Loans is not an application for a mortgage loan, nor is it used to pre-qualify you with any lender. This loan may not be available for all credit types, and not all service providers in the Quicken Loans network offer this or other products with interest-only options. The information that we provide is from companies which Quicken Loans and its partners may receive compensation. This compensation may influence the selection, appearance, and order of appearance on this site.

- Professionals help you file your taxes correctly to maximize your returns.

- Personal property taxes are calculated based on the depreciated value of the asset.

- This value serves as the foundation for calculating real estate taxes, but because the process uses standardized data models, individual property details can sometimes be misrepresented.

- These taxes are used to fund local services such as schools, roads, and public safety.

- Unlike real estate taxes, these are not tied to land ownership — they follow the value and use of individual items.

Is there a deadline for filing property tax protests in Texas?

Don’t confuse government special assessments with homeowners association (HOA) special assessments. Government assessments fund public infrastructure and appear on your property tax bill. HOA assessments are private community fees for shared amenities like pools, clubhouses, or emergency repairs to common areas. Harding & Carbone provides professional guidance for property owners seeking to challenge inaccurate property tax valuations. The firm’s focus is on building strong, data-supported cases that reveal overassessments and lead to fairer property valuations. With extensive experience in property tax law and appraisal practices, Harding & Carbone offers clients the clarity and precision needed to navigate complex tax systems effectively.

- People with permanent disabilities often qualify for property tax exemptions similar to those available to seniors.

- The IRS and your county assessor treat these two very differently, and that affects your taxes each year.

- Many homeowners—especially first-time buyers—see real estate tax and property tax and assume they mean the same thing.

- Mistakes can cost real money and add unnecessary interest payments or lien threats to your financial record.

- A good agent will explain the tax implications of selling your property and help you navigate tax-related paperwork.

Home Office Tax Deductions and Requirements

However, it’s possible for a mobile home to be considered real property if you own the land that the mobile home is usually situated on. In this case the mobile home will be taxed as though it’s real property. High real estate taxes can lower property value because potential buyers consider tax costs when determining affordability.

The Relationship Between School Taxes and Property Taxes

- Generally, rural parts of the country charge lower tax rates than urban cities.

- Taxes can be complex when selling a property, but an experienced real estate agent can guide you through the process.

- Assessors base their understanding on different aspects of the property, such as the location, the amenities available and the condition of the property in order to assign an assessed value.

- Many homeowners pay property taxes through their mortgage payments, but others pay them directly.

- While Icon does not file exemption applications, we do assist clients by reviewing exemption forms to help prevent costly mistakes before submission.

- Regarding the matters discussed in this post, each individual should consult his or her own attorney, business advisor, or tax advisor.

The tax assessment value of your home is $227,500, or $350,000 x 65%. While you may not be able to avoid it altogether, there are some ways you can reduce your obligation. Property owners, investors, and professionals should fully understand these differences to manage their properties and investments wisely.

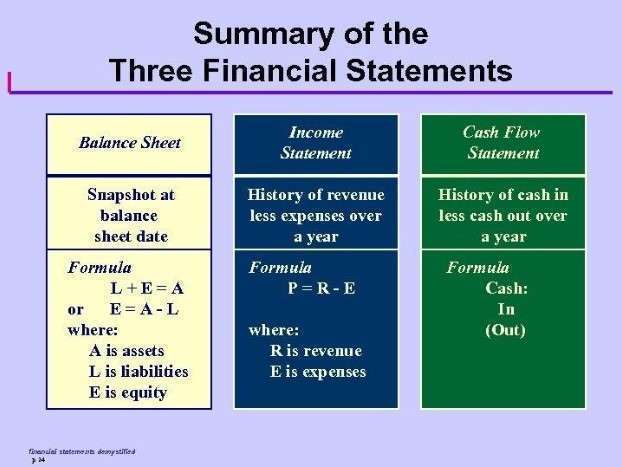

Property taxes, on the other hand, are specifically related to property ownership. They are levied by local taxing jurisdictions, such as counties or municipalities, and are a significant source of revenue for these jurisdictions. Property taxes are imposed on the assessed value of a property, which is determined through an assessment process conducted by local tax assessors. Like real estate taxes, property taxes also contribute to funding local government services and public amenities. Real estate taxes, also known as real property taxes, refer to taxes imposed on the value of real estate properties.

What happens if property taxes are not paid on time?

Additionally, this new tax law limited the “state and local tax” (SALT) deductions to $10,000 per year. The decision to itemize or not is more challenging for taxpayers that live in high state tax areas, own larger homes or both. Tax preparers often calculate their returns both ways to determine which is more advantageous. To understand overall federal tax implications, try our Federal Income Tax Calculator to ledger account calculate total tax liability including rental income.

Real estate vs. personal property taxes: Key takeaways

Eligibility often requires the real estate taxes applicant to meet specific income thresholds or service requirements.

Icon Property Tax analyzes these details and applies data-based adjustments that improve your chances of securing a fairer valuation. Comparable sales often called “comps”, play a major role in challenging a property valuation. These are nearby properties that have recently sold and share similar traits with yours, such as square footage or lot size. Using well-adjusted comps can make a significant difference when appealing your property value, helping to demonstrate a more accurate market comparison. A complex interplay of local, state, and federal laws governs property tax regulations. Staying compliant with these regulations is essential to avoid penalties and legal issues.