Deposit payments into the Undeposited Funds account in QuickBooks Online

Getting rid of undeposited funds in QuickBooks involves a meticulous process of clearing and reconciling pending payments to ensure accurate financial records and transparency. It prevents overstatement of income and avoids discrepancies in reconciliations, which are crucial for decision-making and financial analysis. To resolve this issue, it is essential to regularly review bank and credit card statements, categorize transactions accurately, and use payment matching to identify and merge duplicate entries. Utilizing the ‘Find & Match’ feature and reconciling accounts can also aid in identifying and rectifying any redundant transactions. When you receive cash and check payments from customers, you first place them into the Undeposited Funds account instead of directly depositing them in your actual bank account. When all checks and cash payments are entered and you’re ready to deposit them, you can take them out of the Undeposited Funds account and make a single deposit in your bank account.

Best Accounting Software for Small Businesses of 2024

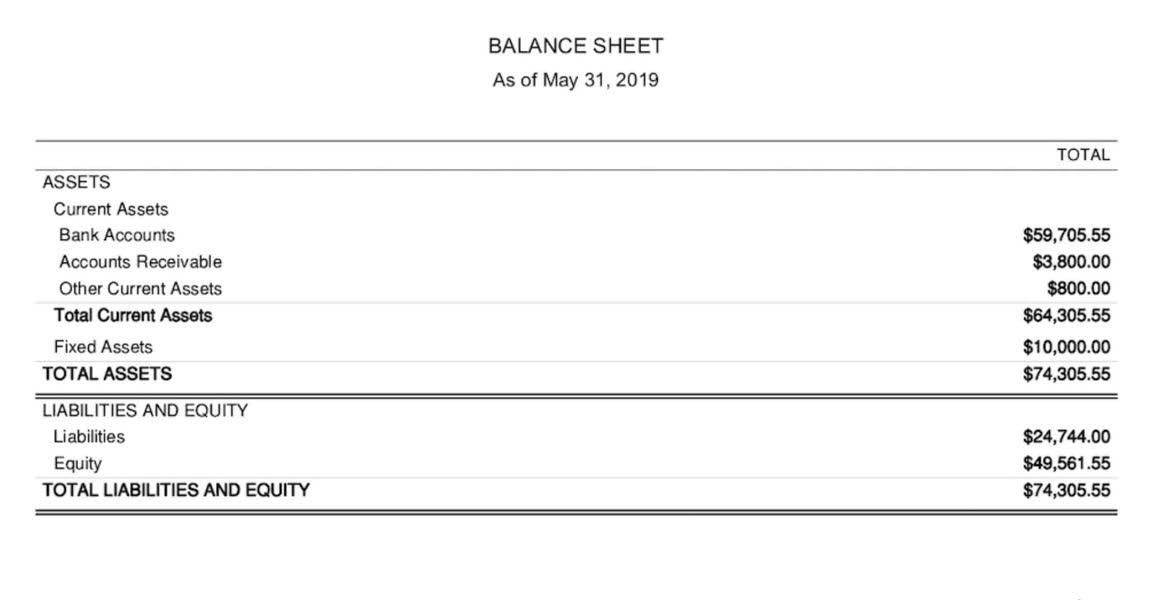

This begins by accessing the Undeposited Funds account in QuickBooks and reviewing what is a condensed revenue assertion all pending payments, ensuring that each transaction matches the corresponding customer invoice or sales receipt. Once verified, the payments should be deposited into the appropriate bank account, and the transactions should be reconciled to reflect the accurate financial status. Identifying and addressing undeposited funds is crucial for financial accuracy, as it ensures that all income is properly recorded and accounted for. Reconciling accounts allows businesses to gain a clear understanding of their financial status, enabling them to make informed decisions for future financial planning and budgeting. It also aids in maintaining compliance and transparency, contributing to the overall integrity of the financial records.

By meticulously comparing the records, businesses can pinpoint any undeposited funds, which may have resulted from delayed deposits or unrecorded income. Once you have logged into your QuickBooks Online account, navigate to the ‘Banking’ tab, and then select ‘Make Deposits.’ From here, you can review and select the undeposited funds you want to clear. It’s crucial to ensure that the deposits are matched with the corresponding invoices and payments, as this will accurately reflect the financial transactions. These funds serve as a temporary holding account and allow for grouping multiple payments together before depositing them into the designated bank account. This process streamlines the bank reconciliation process and ensures that the company’s financial records accurately reflect the transactions.

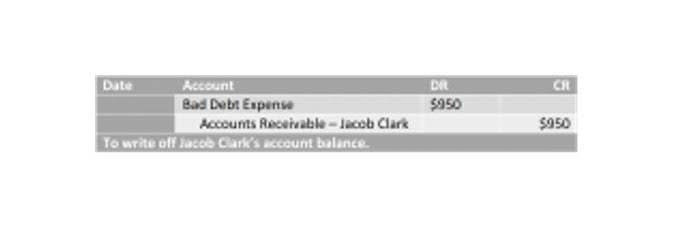

By managing undeposited funds effectively, businesses can gain a clear picture of their cash flow, reduce errors, and maintain a precise record of their financial activities in QuickBooks Online. The funds have now been moved from the Undeposited Funds account to your selected bank account, and the deposit is recorded in QuickBooks. Make sure to reconcile your bank account in QuickBooks to ensure that it matches your actual bank statement. You must use the Undeposited Funds account only for payments that are physically collected, including cash and paper checks. Identifying and addressing duplicate transactions can significantly contribute to fixing undeposited funds in QuickBooks Online, ensuring accuracy and consistency in financial records.

How To Transfer Funds Between Bank Accounts in QuickBooks Online

If you try to do so, QuickBooks Online will just create a new Undeposited Funds account for you. Mark Calatrava is an accounting expert for Fit Small Business. As a QuickBooks ProAdvisor, Mark has extensive are purchases treated as assets or expenses knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software.

This two-step process ensures QuickBooks always matches your bank records. By meticulously cross-referencing the deposited amounts with the corresponding invoices and payments, businesses can gain a comprehensive understanding of their financial transactions. This process facilitates the identification of any discrepancies or outstanding payments, contributing to a more streamlined and transparent financial record. Recording undeposited funds appropriately is crucial for maintaining transparency and accuracy in financial reporting.

- If you see old items, you need to investigate why they are still there.

- No, the Undeposited Funds account itself doesn’t need to be reconciled.

- It’s possible the deposit was posted straight to an Income account rather than matched to payments received.

- Next, fill in the required information in the Receive payment form.

- If you need to delete a bank deposit, click the deposit or amount field in the Deposit Detail report and then click More at the lower part of the screen and then select Delete as shown below.

In case of any discrepancies, double-check the payment and deposit entries to ensure accuracy. Matching deposits to invoices and payments is a critical aspect of clearing undeposited funds in QuickBooks how to create a profit and loss statement for small businesses Online, ensuring accurate reconciliation and financial tracking. The process of clearing undeposited funds in QuickBooks Online involves several important steps to ensure accurate recording and reconciliation of payments. This process involves reconciling the undeposited funds account regularly, which can prevent discrepancies in the financial reports.

Deleting a Bank Deposit

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

So, you need to combine your five separate US $100 records in QuickBooks to match what your bank shows as one US $500 deposit. Turning off undeposited funds in QuickBooks Online requires careful adjustments to the settings and preferences, ensuring that all financial transactions are accurately recorded and reconciled. It’s crucial to maintain consistency in updating and clearing undeposited funds to avoid discrepancies and errors in financial reporting, thereby upholding the integrity of the accounting system. This step involves reviewing all transactions to confirm that the funds awaiting deposit match the actual amounts received.

If your bank records a single payment as its own deposit, you don’t need to combine it with others in QuickBooks. Instead, you can put the payment directly into an account and skip Undeposited Funds. By default, QuickBooks puts sales receipt payments into the Undeposited Funds account. All you have to do is create a sales receipt and QuickBooks handles the rest. When you follow the workflow to receive payment for an invoice, QuickBooks automatically puts them into Undeposited Funds. QuickBooks takes care of invoice payments processed with QuickBooks Payments for you.